Why last mile distributors should minimise untargeted marketing

By Chitraksh Sharma, Lucie Bévierre & Lucie Klarsfeld McGrath at Hystra

Are you spending your marketing budget on the most effective marketing channels for reaching last mile customers? In this short guide we explain the two broad types of marking and give benchmark values for how much your distribution company should spend on untargeted activities.

Below-the-line marketing

For last mile distributors, putting more of your marketing budget into targeted, localised activities is likely to produce better results than untargeted, mass media.

That’s because low-income customers often need to see the product for themselves to be convinced of its benefits. Investing in local marketing – such as demonstrations and door-to-door sales – is typically more effective when it comes to creating trust for risk-averse customers and thus generating sales. These types of targeted activities are called below-the-line marketing.

Above-the-line marketing

Conversely, above-the-line marketing is untargeted and primarily aims to raise brand awareness through use of channels such as national TV and radio, print media and outdoor advertising. Whilst useful for raising the profile of your business and products, it does not necessarily increase trust.

The amount of budget spent on above-the-line marketing costs as a proportion of sales revenue is a good KPI to measure to ensure you’re using your budget effectively.

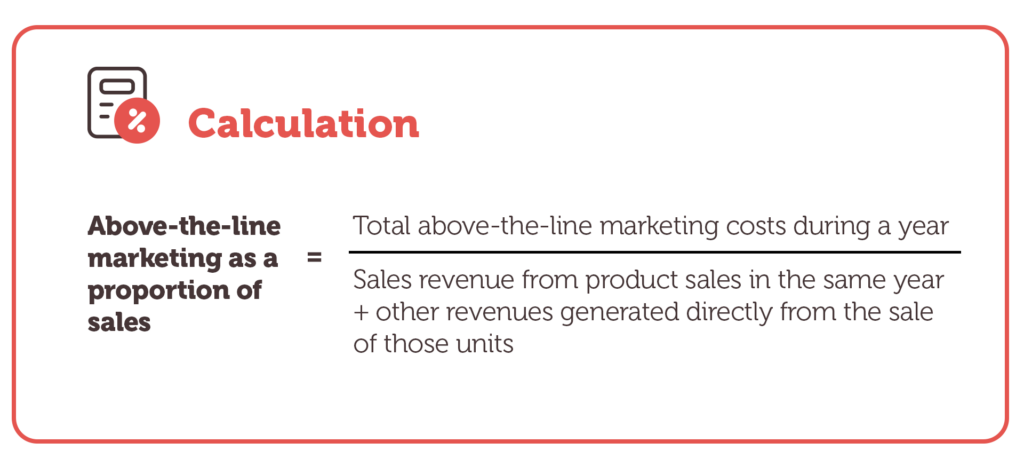

How to calculate the above-the-line marketing KPI

Use the following calculation to measure this KPI:

Above-the-line marketing as a proportion of sales = Total above-the-line marketing costs during a year ÷ (Sales revenue from product sales in the same year + other revenues generated directly from the sale of those units)

This KPI should be measured yearly.

Caveats and clarifications

- The costs of below-the-line marketing and social media campaigns should not be included in the calculation.

- Other revenues include results-based financing and carbon financing.

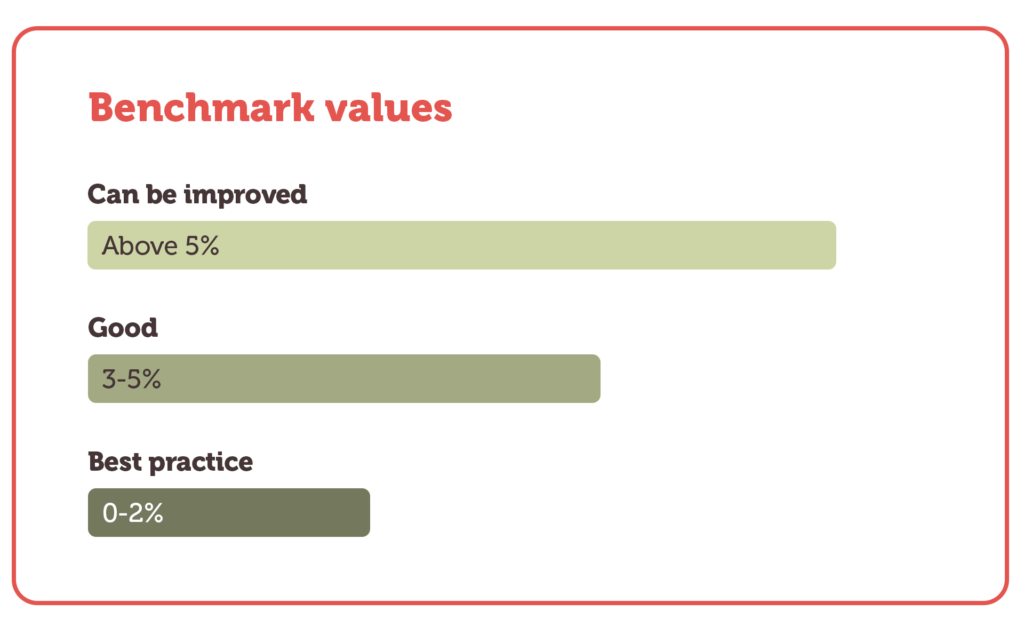

Benchmark values

- Can be improved: Above 5%

- Good: 3-5%

- Best practice: 0-2%

Best practice

Limit above-the-line spend

Limit above-the-line marketing campaigns to local radio adverts, which can be particularly useful in helping potential customers understand where and when they can purchase a product that they have already seen during a demonstration or heard about from customers within their community.

Invest in below-the-line marketing

Below-the-line marketing such as demonstrations allow potential customers to verify the quality and benefits of the product for themselves, which is especially important for customers with little experience with the product or technology. In countries where social media are widely used by your target customers, leverage those as targeted marketing channels as well.

Identify key marketing channels

Identify not only the motivations for purchase (e.g. saving money, saving time, better customer service) but also the reasons for non-purchase (e.g. opposition from a family member, complexity of transporting the product home) and tailor marketing messages and channels to address these.

Identifying those barriers and preferred channels can be done via yearly surveys of customers and non-customers, possibly as part of those suggested in KPI 2: Unique selling proposition.

More last mile distribution KPIs and benchmarks

You can find more ways to measure the performance of your company in our Benchmarking KPIs for Last Mile Distributors publication. This resource contains explanations and benchmarks for 23 different KPIs, as well as guidance on best practice and additional resources.

In particular, you might find the following related KPIs from the publication useful:

KPI 2: Unique selling proposition

Marketing messages and channels should ideally be based on a good understanding of both unique selling points and barriers to purchase.

KPI 9: Market penetration

Above-the-line marketing campaigns might help increase adoption at a national level over the short-term but will do little to encourage group sales that deepen local penetration over time.

Additional resources on marketing

Here’s another resource that might help you improve your marketing:

- Marketing Innovative Devices for the BoP, Hystra, 2013

Sources

Main article

This content was adapted from KPI 8: Above-the-line marketing in Benchmarking KPIs for Last Mile Distributors, written by Hystra in partnership with the Global Distributors Collective.

Benchmark values

- Hystra analysis

Top image

- The black and white photo of the woman has been adapted from an image by freepik.

- The radio illustration has been adapted from an image by Freepik.

Funded by Transforming Energy Access

This material has been funded by UK aid from the UK government via the Transforming Energy Access platform; however, the views expressed do not necessarily reflect the UK government’s official policies.